Margin Of Safety Book Price

If you look to Mr. This 1991 book is an investing classic so much so that it sells for 780 on the secondary market.

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

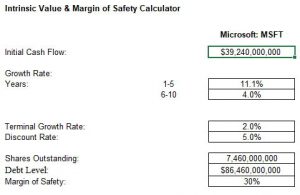

Value investing the strategy of investing in securities trading at an.

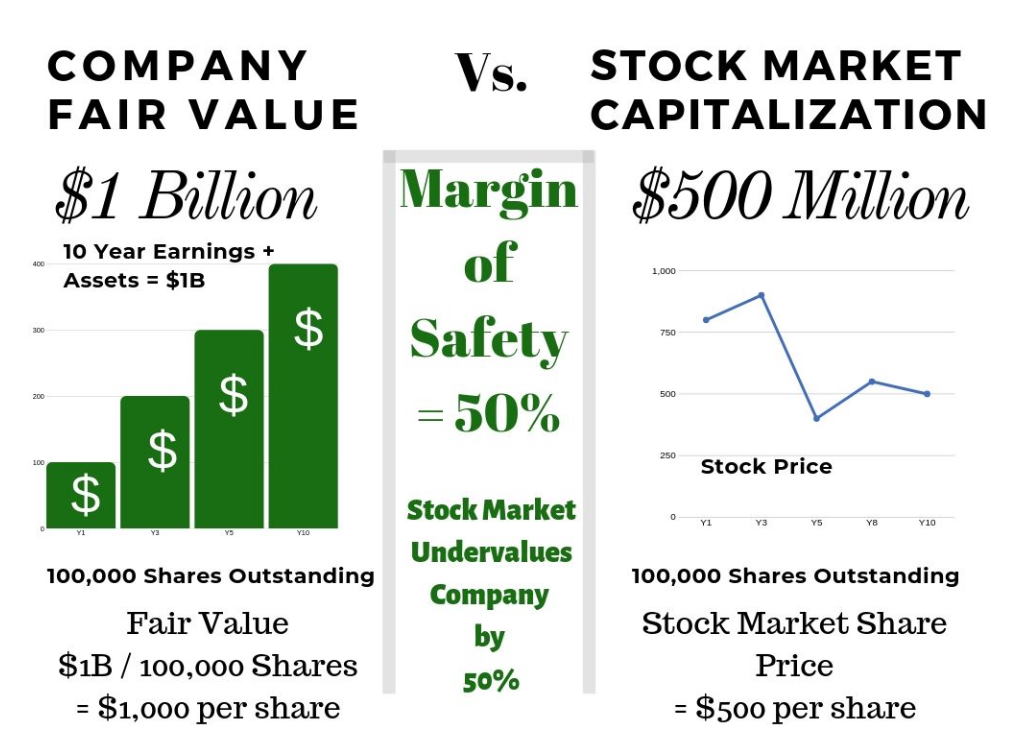

Margin of safety book price. Simply put it is the difference between the intrinsic value of a stock and its market price It also refers to how far a business sales can fall before breaking even. This 1991 book is an investing classic so much so that it sells for 780 on the secondary market. Let us assume that the book value per share of a company is 10 but the market price of one share is 20.

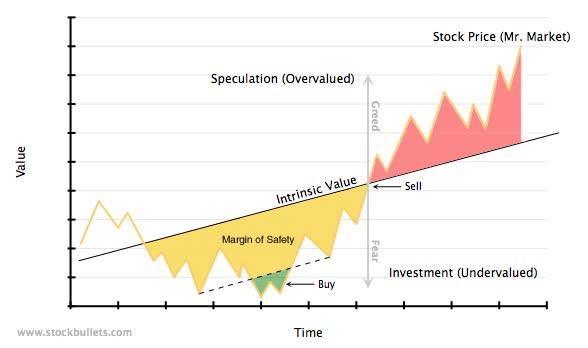

There are many roads that lead to Rome and giving a road map that. Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. Margin of safety.

The key insight for most value investors is the all investments must have an inherent margin of safety. Risk-Averse Value Investing Strategies for the Thoughtful Investor book online at best prices in India on Amazonin. For the remainder of the book I recommend one particular path for investors to followa value-investment philosophy.

I found his evaluation method muddled or at least his explanation is not the easiest to understand. I find it ironic that a second-hand book on value investing and margin of safety sells for over 600. Read Margin of Safety.

The book is in three parts. Margin of Safety Berechnung und Formel. For any security it will be large at one price small at some higher price nonexistent at some still higher price.

Margin of Safety in Dollars Current Sales Breakeven Sales Margin of Safety in Units Current Sales Units Breakeven Point. Margin of Safety is a famous phrase coined by Ben Graham half a century ago and taken up by Seth Klarman here as a full volume. Purchased a new piece of machinery to expand the.

In other words when the market. The terminology is important as it helps you to understand more of what Klarman discusses in the chapters of the book. Even a billionaire value investor shouldnt buy this out of.

In the first section I identify many of the pitfalls that face investors. Market as a creator of investment opportunities where price departs from underlying value you have the makings of a value investor. By highlighting where so many go wrong I hope to help investors learn to avoid these losing strategies.

Die Margin of Safety Berechnung ist wie du siehst nicht sonderlich kompliziert. This book is a loud trumpet for value investing and its merits. - confusing speculation with investing.

The book initially sold just 5000 copies for 25 a piece and it was considered a flop. Goals in writing this book are twofold. So in the starting period its at a 15 discount then later only 10 5 and eventually is at fair value.

Amazonin - Buy Margin of Safety. Hierzu gibt es diese einfache Margin of Safety Formel. Margin of Safety is an excellent guide for investors because it focuses on how to succeed by not failing.

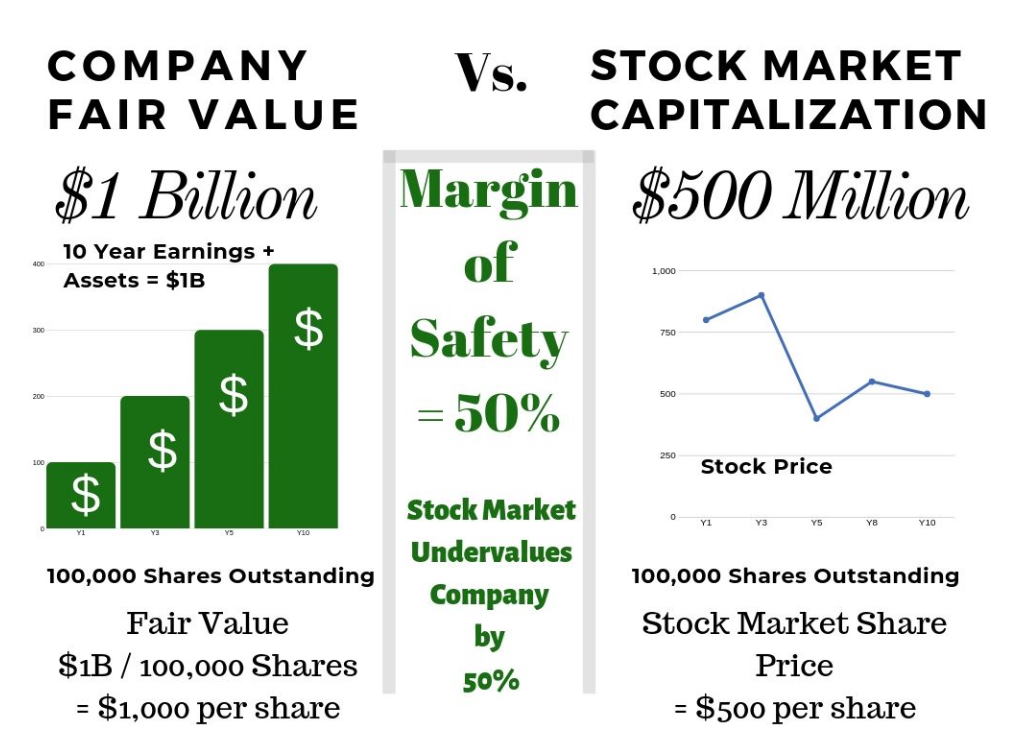

Risk-Averse Value Investing Strategies for the Thoughtful Investor book reviews author details and more at Amazonin. So in this scenario even though we know for a fact that the value of one share of this company. Price Vs Value Value in relation to price not price alone must determine your investment decisions.

While Margin of Safety is the title of the book it refers to an aspect of the stock market. The key insight for most value investors is the all investments must have an inherent margin of safety. The notion of risk.

Free delivery on qualified orders. That means looking at the downside before looking at the upside. Du erhltst ber diese Formel einen Prozentwert der angibt wie viel Margin of Safety.

That means looking at the downside before looking at the upside. Die aktuelle Margin of Safety kann relativ einfach berechnet werden wenn Du den inneren Wert einer Firma bestimmt hast. According to Graham The margin of safety is always dependent on the price paid.

Over this ten year period lets say the price of the stock gradually increases back up to fair value as the market sees this company continue to perform well. The book is comprised of three main parts. In 1991 when Seth Klarman was 34 years old he published Margin of Safety with the publisher HarperCollins.

Just like Charlie Mungers saying All I want to know is where Im going to die so Ill never go there Seth Klarman devotes the first part of the book to highlight how most investors stumble. Margin of Safety Current Sales Level Breakeven Point Current Sales Level x 100. Evaluate a company from the bottom up and look to buy it at a discounted price which is his margin of safety.

So the price increases from 2295 to 44. The margin of safety formula can also be expressed in dollar amounts or number of units. A margin of safety is achieved when securities are purchased at prices sufficiently below underlying value to allow for human error bad luck or extreme volatility in a complex unpredictable and rapidly changing world.

The difference between the market price and the book value is the margin of safety. Remember that the market price of a share may not always represent the value of that share. Seth Klarman through his Baupost Fund is one of the greatest investors of the current generation perhaps of all-time.

Margin Of Safety The Three Most Important Words In Investing

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Margin Of Safety Buffett Graham S Magic Formula Explained

How To Use A Margin Of Safety When Investing Dividend Monk

Margin Of Safety The Three Most Important Words In Investing

Intrinsic Value And Its Relationship To Margin Of Safety Arbor Asset Allocation Model Portfolio Aaamp Value Blog

Margin Of Safety The Three Most Important Words In Investing

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman 1991 Hardcover For Sale Online Ebay

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

7 Best Value Investing Books That You Cannot Afford To Miss

7 Best Value Investing Books That You Cannot Afford To Miss

Here Are My Notes Taken From The Intelligent Investor By Benjamin Graham By Jensen Loke Medium

Margin Of Safety Buffett Graham S Magic Formula Explained

Why Margin Of Safety Is Misunderstood And Not Used Enough Old School Value

Margin Of Safety Buffett Graham S Magic Formula Explained

Download Pdf Modern Value Investing 25 Tools To Invest With A Margin Of Safety In Today S Financial Environment Value Investing Investing Dividend Investing

How Seth Klarman S Margin Of Safety Will Make You A Better Investor

Margin Of Safety Risk Averse Value Investing Strategies For The Thoughtful Investor By Seth A Klarman

Post a Comment for "Margin Of Safety Book Price"